India’s electric passenger-vehicle segment has shifted from a niche market to a mainstream automotive story. Calendar Year 2024 (CY2024) closed with ~99,000 EV car/SUV registrations — the highest ever for the country, reflecting a 20% year-on-year growth. Unlike earlier years, where volumes were modest, 2024 signalled apparent customer acceptance, better product availability, and more competitive pricing.

What’s equally fascinating? The psychology of Indian EV buyers. It’s not just about a car anymore — economics, convenience, and status. Let’s break it down.

Who’s Leading the EV Sales Race?

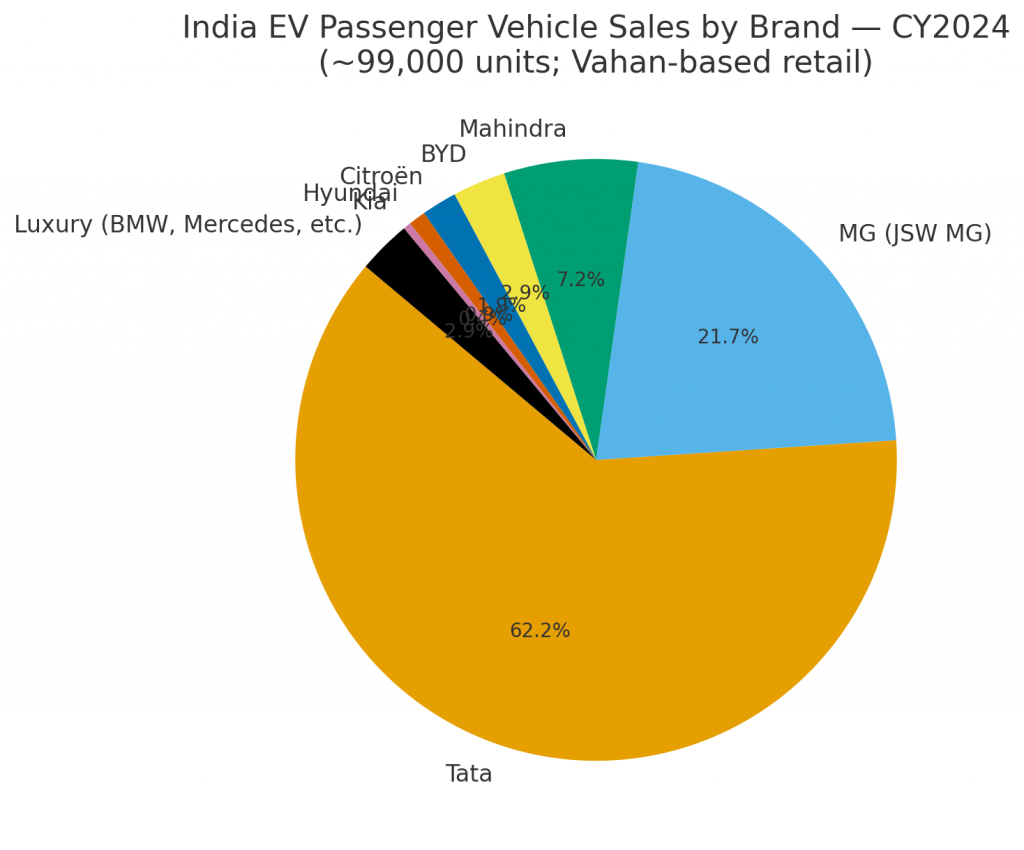

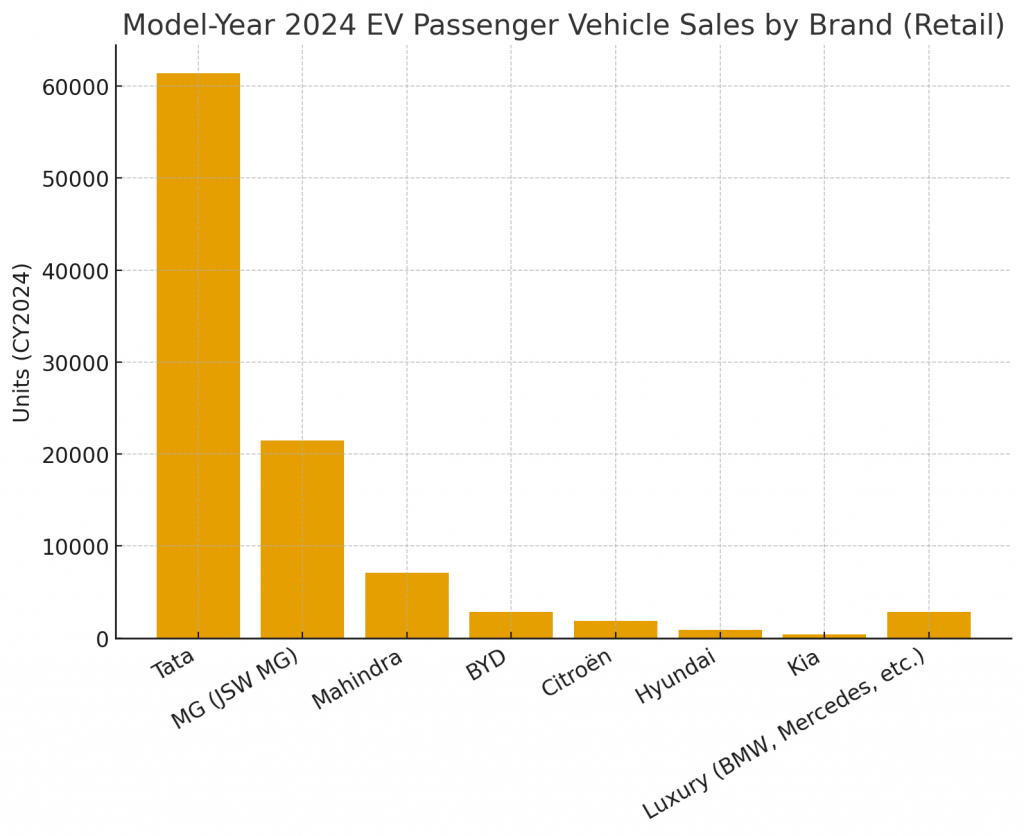

Brand-wise EV Car/SUV Retail Sales in CY2024 (Vahan data):

| Brand | Units (CY2024) | Remarks |

| Tata Motors | 61,435 (~62%) | Tata owns the electric car space right now because they’ve got something for everyone’s budget. Whether you want the basic Tiago EV or you’re looking at the fancier Curvv that just launched, they’ve covered all the bases. Plus, they’re smart about it – they keep tweaking prices when needed, offer EMI deals that don’t hurt your wallet too much, and you can find their service centres in most cities. That’s why everyone else is still playing catch-up. |

| MG Motor India (JSW MG) | 21,464 (~21%) | MG had a breakout year with Windsor EV, ZS EV and Comet EV. Their Battery-as-a-Service (BaaS) and free charging bundles struck a chord with cost-conscious urban customers who hesitate over battery degradation concerns. |

| Mahindra | 7,104 (~7%) | The XUV400 has been Mahindra’s only mainstream EV so far, but momentum is building with BE 6 and XEV 9e in 2025. Mahindra benefits from semi-urban networks, making it well-positioned to convert ICE loyalists. |

| BYD | 2,819 (~3%) | BYD focuses on premium EVs (Atto 3, Seal). While volumes remain low, their EVs stand out for long range, superior interiors, and robust performance. |

| Citroën | 1,873 (~2%) | The Citroën C3 electric tried to be the budget-friendly hatchback everyone awaited, but it encountered some real problems. The charging was painfully slow, and most people in India don’t know much about Citroën as a brand yet. Still, if you’re in Mumbai or Delhi and you like that quirky French design, the price tag does make it tempting. |

| Hyundai | 910 | Hyundai’s Kona Electric and Ioniq 5 play in niche segments. The upcoming Creta EV will be critical for 2025-26 growth. |

| Kia | 408 | Kia’s EV6 remains niche; the EV9 launch in 2025 will be its mainstream test. |

| Luxury (BMW, Mercedes, Volvo, Audi, etc.) | 2,828 | Luxury EVs are small but growing fast. BMW iX/i4, Mercedes EQ line, and Volvo’s XC40/C40 attract first-time luxury buyers seeking green status symbols. |

New Entrants in 2025–26: VinFast & Others

Several new entrants are stepping into India’s EV space around 2025–26, bringing fresh dynamics that will affect incumbents, customer expectations, and the ecosystem. VinFast is the most prominent, but there are others to watch.

VinFast: The Big New Challenger

VinFast, which Vietnam’s Vingroup owns, is putting serious money where its mouth is – it’s investing $2 billion to set up shop in India. They’ve picked Thoothukudi in Tamil Nadu for their factory, and they’re starting with the ability to make 50,000 cars a year. If things go well, they can ramp that up to 150,000. Their first two models coming to India are the VF6 and VF7 electric SUVs. Word is the VF6 will start around ₹16.5 lakh, while the bigger VF7 is expected to be priced at about ₹20.9 lakh.. Bookings are anticipated by mid-2025 with local assembly (CKD kits) at the new facility, later moving toward higher localisation.

VinFast’s arrival will shake up the market by:

– Increasing competition in the premium EV segment (₹15–25 lakh).

– Forcing faster localisation and cost reduction by incumbents.

– Raising customer expectations around features, ADAS, and ownership experience.

– This whole EV shift creates new business opportunities for parts suppliers, EV-charging station companies, and service networks.

Upcoming Entrants

Beyond VinFast, several brands are preparing their EV launches in India:

– Maruti’s finally jumping into electric cars with the e-Vitara, and they’ve got dealerships everywhere to push it

– Hyundai will introduce the Creta EV, while Kia will expand with the EV9.

– BYD is adding to its global models like Atto 3 and Seal.

– Reports suggest that Tesla and other Chinese OEMs may test Indian waters in 2025–26.

Implications for the Market

1. Car companies are going all-out to win customers in the ₹15–25 lakh price range – it’s where the real competition is happening

2. Everyone from startup brands to big names like Maruti and Hyundai is focusing on making cars in India that suit Indian conditions.

3. People aren’t willing to compromise anymore – they want proper warranty coverage, fair prices, and service centres that don’t give them the runaround.

4. Suppliers and charging networks will find new growth opportunities in this evolving market.

5. As new players decide between volume-driven mass premium or higher-end niches, strategic price positioning will be key.

Pie Chart: India EV Passenger Vehicle Brand Share, CY2024 (Retail).

Bar Chart: EV Passenger Vehicle Sales by Brand, CY2024 (Retail).

Customer Psychology Driving EV Adoption

EV adoption in India is not just about specifications but mindset. Here are the five dominant psychological levers:

1. Range & Charging Anxiety — The First Filter

Most people looking at electric cars don’t even get to the price discussion first. A Deloitte study from last year confirmed what we all suspected – people are most worried about finding EV charging stations and how long it takes to charge up. That’s precisely why the EVs that actually sell well are the ones that can go 250-450 km on a single charge and let you plug them in at home overnight.

2. The EMI Sweet Spot Matters More Than Price Tag

Unlike Western markets, Indian buyers think in monthly EMIs. A ₹10–15 lakh EV may sound costly upfront, but customers leap if brands like Tata or MG can offer competitive EMIs matching a petrol SUV + fuel costs. Battery rental models (BaaS) further reduce EMIs, de-risking battery life concerns.

3. Home & Workplace Charging = Convenience King

McKinsey research confirms: Indians overwhelmingly prefer home or workplace charging. Public charging is seen as ‘backup’ rather than ‘primary.’ Compact EVs thrive among metro dwellers with fixed parking, while renters delay purchases unless workplace charging is assured.

4. SUV Stance + Tech Features = Appeal Multiplier

Indians love SUVs — and this reflects in EV sales too. The Nexon EV and Punch EV outsell sedans and hatches because they look premium, feel safer, and suit road conditions. Add connected features, large screens, and now ADAS, and buyers feel they’re getting more than just an ‘eco-car.’ Luxury EVs double this appeal with futuristic cockpits.

5. Values + Math = Adoption Catalyst

People switch to electric when caring about the environment, and saving money on fuel and maintenance. The real dealbreakers are solid 8-year battery warranties, buyback guarantees, and upfront service pricing.

2025-26 outlook:

– Tata will remain dominant, but MG’s affordable EVs and Mahindra’s BE range will test lead.

– Hyundai’s Creta EV could be a game-changer in the SUV segment.

– Luxury EVs will grow faster in percentage terms as aspirational buyers see EVs as both green and status upgrades.

– Customer psychology will keep evolving — but EMI affordability and charging ecosystem will remain the biggest triggers.

References

- Autocar India — India’s EV PV sales hit 99,000 units in 2024

- Autocar Professional — CY2024 EV market update

- Electrive — India achieves record-high EV car sales

- EVReporter — Vahan-based EV trend analysis

- Deloitte Global Auto Survey 2024 — Indian EV buyer sentiments

- McKinsey — EV charging preference in India

- Reuters / Times of India — MG BaaS, Tata price cuts, Nexon EV ADAS

Leave a Reply